Record cold temperatures. Severe snow and rainstorms. A delayed start to the season for much of the country. Things weren’t shaping up for many retailers quite as they would’ve liked them to earlier this year. However, by the time summer was through, our research painted a different picture. More than 540 retailers weighed in on our State of the Industry Survey, and the season ended well for most, with 72 percent of stores experiencing increased sales in 2014.

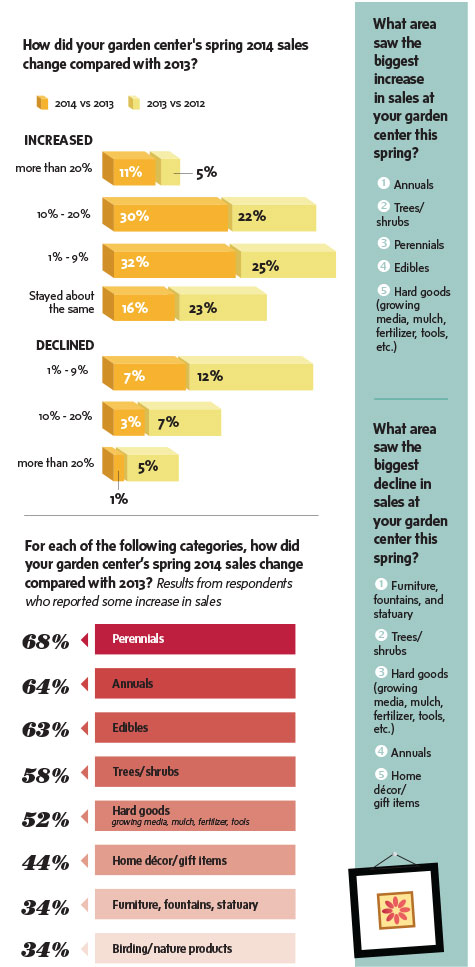

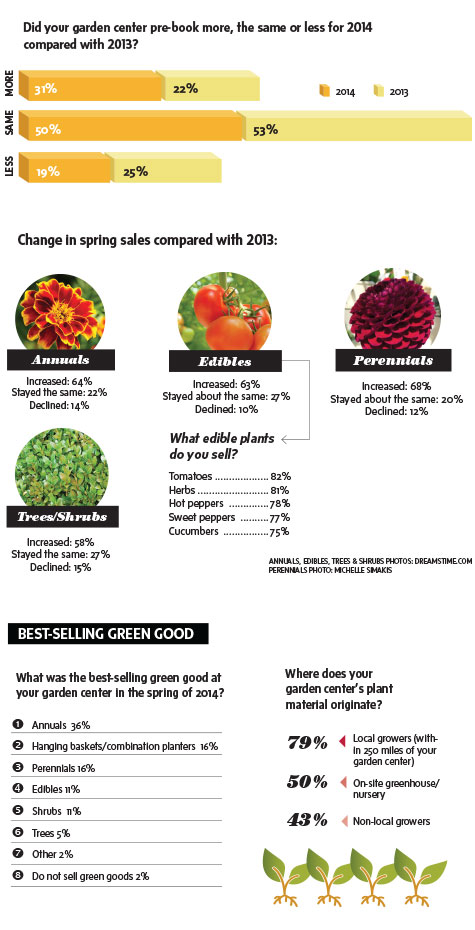

When it came to what was selling and what wasn’t, there were a few notable departures from last year’s results. Tree and shrub sales showed marginal increases despite a flat housing market, a phenomenon we can attribute at least in part to the harsh winter weather that destroyed many well-established trees and shrubs, even in southern locales. Perennials also made a strong showing this year, with 68 percent of retailers reporting an increase in sales, in contrast to 51 percent in 2013.

As we attended trade shows, visited garden centers and chatted with others in the industry, the vibe has been more positive than in year’s past, with hope for the future. Over the following pages, you can take a look at how your peers did this year, compare that with how your business fared and keep it in mind as you plan for next year. Managing editor Michelle Simakis and I share our commentary throughout the section.

As we attended trade shows, visited garden centers and chatted with others in the industry, the vibe has been more positive than in year’s past, with hope for the future. Over the following pages, you can take a look at how your peers did this year, compare that with how your business fared and keep it in mind as you plan for next year. Managing editor Michelle Simakis and I share our commentary throughout the section.

Survey says...

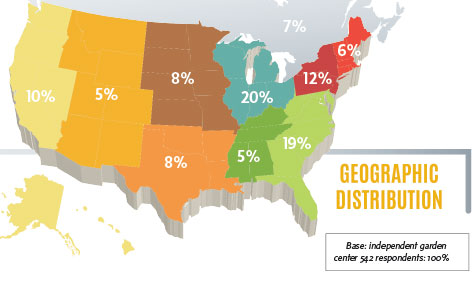

The data on the following pages was collected by Readex Research via an online survey from August 7 to 18, 2014. The survey was closed for tabulation with 691 responses. To best represent the audience of interest, the results in this report were based on the 542 respondents who indicated they own/operate/manage an independent garden center.

The margin of error for percentages based on 542 usable responses is ± 4.0 percentage points at the 95% confidence level. That is, 95% of the time we can be confident that percentages in the actual population would not vary by more than this in either direction. —Garden Center magazine

Garden Center Details

To diversify or not: that is the question

KV: I had the opportunity to speak with Jay Meadows, president of Meadows Farms on the East Coast, just after Memorial Day weekend. Meadows said that the company, the top grossing operation on our Top 50 list last year, has shifted some of its focus into expanding its landscaping division to compensate for slower plant sales, a move that he recommends other stores consider. We’ve seen that diversification can be key to continued success, but not without added effort. Elizabeth Skehan-Russell of Russell’s Garden Center in Massachusetts told us that their diversity has helped them thrive. “Through the rough economic times, we’ve had surprising departments pull us out,” she says. “Our diversity has helped us, [but] it’s a more complicated business plan.”

KV: I had the opportunity to speak with Jay Meadows, president of Meadows Farms on the East Coast, just after Memorial Day weekend. Meadows said that the company, the top grossing operation on our Top 50 list last year, has shifted some of its focus into expanding its landscaping division to compensate for slower plant sales, a move that he recommends other stores consider. We’ve seen that diversification can be key to continued success, but not without added effort. Elizabeth Skehan-Russell of Russell’s Garden Center in Massachusetts told us that their diversity has helped them thrive. “Through the rough economic times, we’ve had surprising departments pull us out,” she says. “Our diversity has helped us, [but] it’s a more complicated business plan.”

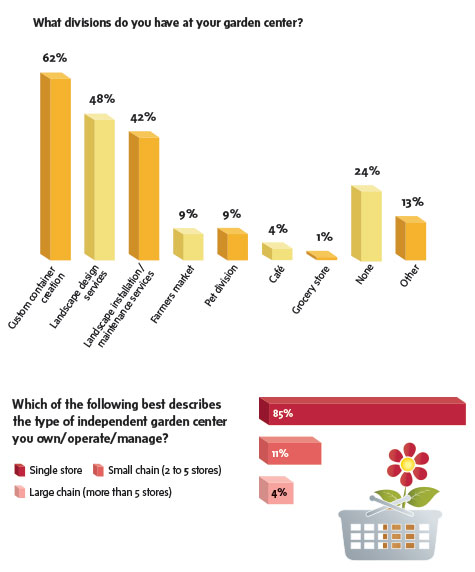

MS: Eighty-six percent of respondents have at least one division in their garden center, illustrating the need for businesses to diversify. The percentage of survey takers who said they offer custom container creation increased from 49 percent in 2013 to 62 percent this year, the largest increase of all categories. Platt Hill Nursery’s custom and pre-made containers help set the store apart from other garden centers in the Chicago area, according to the designer, who has been carefully crafting baskets and pots for more than 20 years and has seen a surge in demand. Though only 9 percent of garden centers reported they have a pet area, some have found it extremely successful. Chalet garden center in Wilmette, Ill., for example, pulls in about $1 million in sales from its pet department each year, accounting for one-tenth of the garden center division’s total annual sales.

General Business Management

Retailers hold their own

KV: Overall, sales were up for 72 percent of retailers this year, compared to only 53 percent last year. We also saw that significantly fewer retailers reported decreased sales this year, 11 percent compared with 23 percent last year. Another way to look at it is that, for 89 percent of respondents, sales were at least as good as 2013, if not better. That means that the vast majority of retailers seem to be holding their own. If we take a look further back, that figure was 76 percent in 2013, and 78 percent in 2012.

MS: More respondents reported an increase in sales than a decline for all categories, and the following is the specific percentage and category. Perennials accounted for the largest change from 2013 to 2014, increasing a whopping 17 percent. Annuals also jumped from 48 percent to 64, a 16 percent change from last year’s report.

KV: It’s exciting to see that green goods seem to be up for a majority of retailers this year. Now it’s time to see how retailers can maintain that growth — it is with more add-on or package sales? Is it by taking a different approach to marketing plants, such as emphasizing their organic or local traits, as mentioned by Ben Campbell in his article in January? The key is finding what works for your store and not being afraid to adapt to changing demands and market conditions.

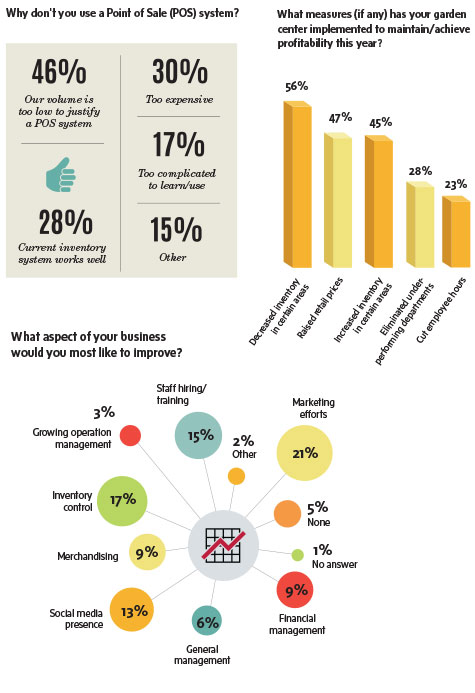

MS: A fifth of independent garden centers want to ramp up their marketing efforts, and 9 percent also want to improve merchandising. We can help, and soon! Stay tuned for our November/December issue when we focus on marketing and merchandising techniques and provide more results from this survey about those efforts.

KV: We asked readers about their use of Point of Sale (POS) Systems, and found that 43 percent did not use them. Here are the reasons they gave for not using them:

More folks on the floor

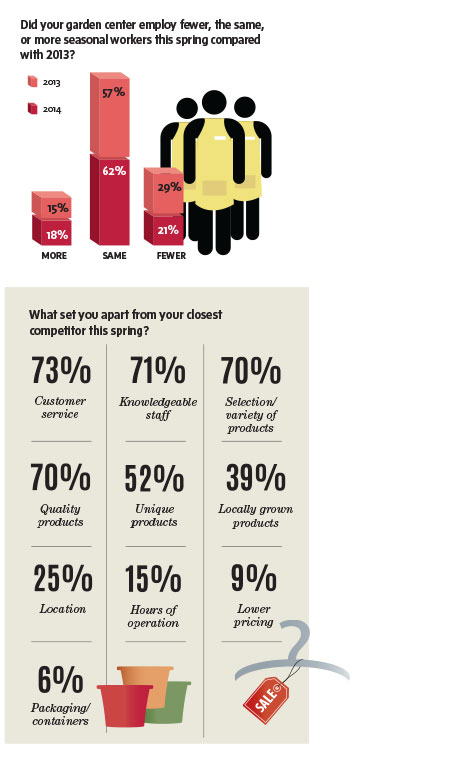

MS: This statistic (first chart below) is trending in the right direction. Independent garden centers hired more seasonal workers this year, and the percentage of respondents who reported that they hired fewer people dropped by 8 percent. Customer service and unique, quality products (second chart below) remain king for IGCs.

Customer Loyalty

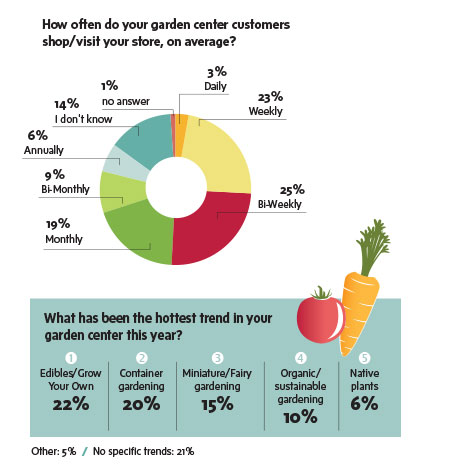

MS: More than 50 percent of respondents (first chart below) said their customers shop their stores at least bi-weekly. And 70 percent say gardeners stop by at least monthly. Those are some pretty loyal customers.

Green Goods

Plants make modest comeback

MS: Garden centers across the country reported that they sold more trees this year than in the past because of the powerful storms that swept the nation in 2012 and 2013. More people pre-booked, and fewer people said they pre-booked less for 2014. Another trend in the right, steady direction.

KV: Buddy Perino of Perino’s Garden Center in Louisiana, where a January deep freeze shut down the New Orleans area for a few days and ruined landscapes, said that this season was exceptional, due in part to customers replacing weather-damaged trees and shrubs. Perennials also seem to be making a comeback, and edibles are still going strong.

Hard Goods

Bare necessities

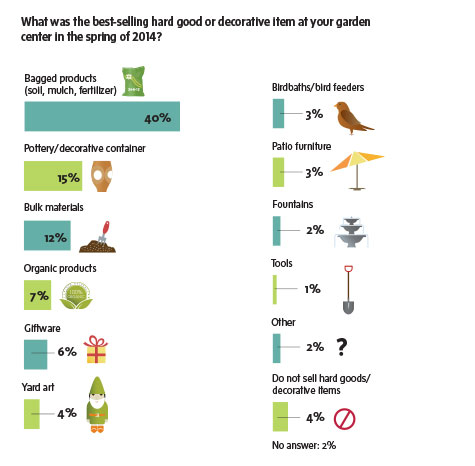

MS: These responses suggest that customers still turn to independents for their gardens’ basic needs — soil, mulch, fertilizer and pottery. However, very few of the garden centers we spoke to sold plants exclusively, which follows the trend and necessity that garden centers diversify their businesses.

Explore the October 2014 Issue

Check out more from this issue and find you next story to read.

Latest from Garden Center

- Proven Winners introduces more than 100 new varieties for 2025

- Weekend Reading 5/10/24

- The Family Business, Part 2: Agreeing (and disagreeing) on capital investments

- Registration opens for Darwin Perennials Day

- Weekend Reading 5/3/24

- Weekend Reading 4/26/24

- Smith Gardens assumes operations of Skagit Horticulture

- Beneficial insect sachets now included with Monrovia mandevilla