The launch of Apple Pay and Google Wallet has created tremendous buzz in the retail industry, but has it created enough traction yet to become a necessity for your POS systems? We’ve broken down the stats to help you make an informed decision.

Apple Pay and Google Wallet are both mobile payment options that eliminate the need to carry a debit or credit card. Retailers can use devices at the register that will scan a phone (which has an encrypted version of the debit card number, so identity theft is a lesser possibility) and the payment is made through the patron’s bank account.

Sources: www.fastcompany.com/3041353/fast-feed/starbucks-mobile-app-payments-now-represent-16-of-all-starbucks-transactions

www.businessinsider.com/apple-pay-statistics-2014-12

www.statista.com/statistics/244496/average-spending-per-us-proximity-mobile-payment-transaction-user/

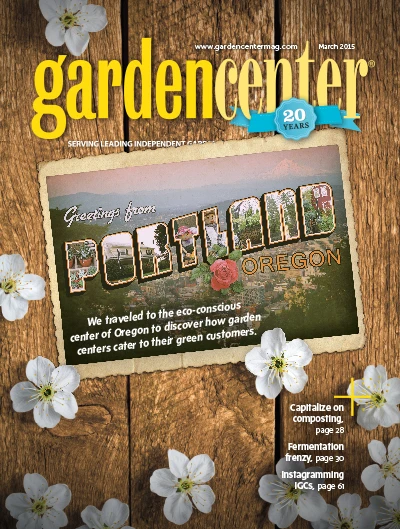

Explore the March 2015 Issue

Check out more from this issue and find your next story to read.

Latest from Garden Center

- The Growth Industry Episode 10: State of the Horticulture Industry

- Scientists develop vitamin A-enriched tomato to fight global deficiency

- Tennessee Green Industry Field Day scheduled for June 11

- UTIA and UT Knoxville research teams will develop automated compost monitoring system

- Ken and Deena Altman receive American Floral Endowment Ambassador Award

- Native before it was cool

- Proven Winners partners with Pure Line Seeds to offer vegetable plants

- [WATCH] Taking root: The green industry’s guide to successful internships