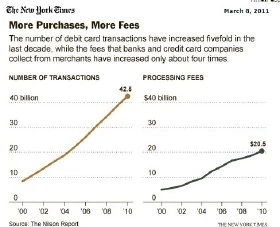

Last year the Senate passed an amendment directing the Federal Reserve to reduce hidden “swipe fees” banks collect from retailers when customers use a debit card for a purchase. Merchants, who complained of an annual loss of $20.5 billion due to fees, were elated.

However, bank lobbyists are fighting back as the Fed faces a deadline in April to write the rules for the lower fees. The proposed cut will lower bank profit from an average of 44 cents per transaction to 12 cents.

Bank lobbyists contend that the reduced cut will leave many of them unable to afford to issue debit cards to customers or force them to raise other consumer banking charges to cover the costs. Lobbyists also say the fee cap will be profitable for giant retailers like Home Depot and Wal-Mart, which generate the bulk of debit card transactions, but do little for small retailers.

Judy Woodruff of PBS NewsHour spoke with the American Bankers Association's Nessa Feddis and the National Retail Federation's Mallory Duncan about the battle over fees and the impact on consumers.

Follow the link if you would like to view the discussion. Click here if you would like to view the full New York Times article.

Latest from Garden Center

- Scientists develop vitamin A-enriched tomato to fight global deficiency

- Tennessee Green Industry Field Day scheduled for June 11

- UTIA and UT Knoxville research teams will develop automated compost monitoring system

- Ken and Deena Altman receive American Floral Endowment Ambassador Award

- Native before it was cool

- Proven Winners partners with Pure Line Seeds to offer vegetable plants

- [WATCH] Taking root: The green industry’s guide to successful internships

- Award winners announced for 2026 PHS Philadelphia Flower Show